Number and amounts of announced funding rounds over the past 6 months*

* All data from crunchbase, as of Oktober 2, 2023

IT startups take the second place for the most popular investment industry

- During the month of September, 455 financing rounds were announced.

- The total amount invested in the announced financing rounds was $7.2bn, increasing by 280% compared to previous month.

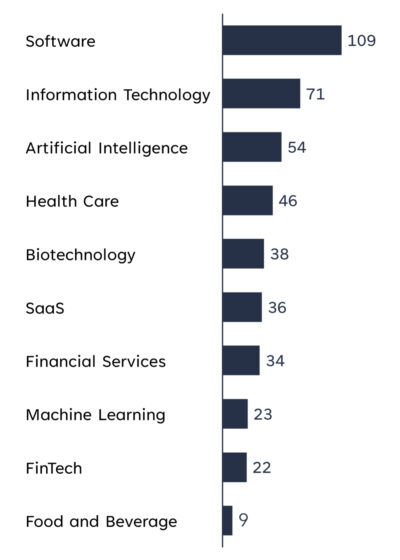

- Similar to previous months, most investments were made in Software companies, amounting to 109 investments, followed by Information Technology (71).

Top 10 industries of financed startups according to the number of conducted investments

Bpifrance is the most active investor of September

Investors with the highest number of investments in September

Number and total volume of financing rounds per stage

Largest round of September was a Series C Round of $2.1bn

In September, most investment rounds were Seed Rounds (~42%). Despite that, a volume of $1.5bn was invested in 86 Venture Rounds.

London is the european venture capital industry hotspot, while Paris takes the second spot

- The most investments in September were conducted in the UK (120), followed by Germany (67) and France (64).

- When ranking by investment volume instead of the number of conducted investments, France takes first place ($2.8bn). UK ranks second by volume ($1.9bn).

In the spotlight: Verkor raised $2.15bn in September in a Series C round

Company

Industry

Battery

Founded in

2020, Grenoble

One-Sentence-Pitch

Verkor is a battery cell manufacturer whose goal is to increase the production of low-carbon batteries to fulfill the growing demand for electric vehicles.

Financing round

Money raised

$2.15bn / €2.00bn

Type of financing round

Series C

Comment/Quote

On September 14, Verkor secures $2.15bn to launch a high-performance battery gigafactory in France and accelerate future sustainable mobility. The largest equity raise for a French start-up.

Investors

Partner with us

Unlock the full potential of your financial strategy with Trustventure’s expert guidance. Whether you’re navigating challenges in the financial sector, seeking advice on corporate financing, or enhancing your planning and controlling processes, we’re here to empower your journey and help you create transparency and confidence for both you and your investors.

Ready to elevate your financial game? Reach out to us today using our contact form or drop us a direct message at office@trustventure.de. Work with us to achieve your financial success!