Number and amounts of announced funding rounds over the past 6 months*

* All data from crunchbase, as of Oktober 2, 2023

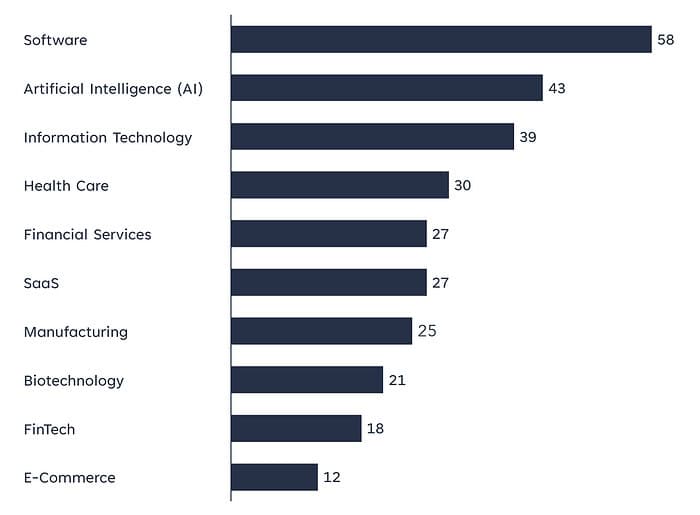

AI startups take the 2nd place for the most popular investment industry, amounting 43 investments.

- During the month of December, 307 financing rounds were announced.

- The total amount invested in the announced financing rounds was $2.8bn, decrease by 33% compared to previous month.

- Similar to previous months, most investments were made in Software companies, amounting to 58 investments.

Top 10 industries of financed startups according to the number of conducted investments

Bpifrance is once again the most active investor

Investors with the highest number of investments in December

Number and total volume of financing rounds per stage

Largest round of December was a Series A of $414.5mn

In December, most investment rounds were Seed Rounds (~45%). Despite that, the largest volume of $847.0mn was invested in only 33 Series A Rounds. No Series D Round was conducted.

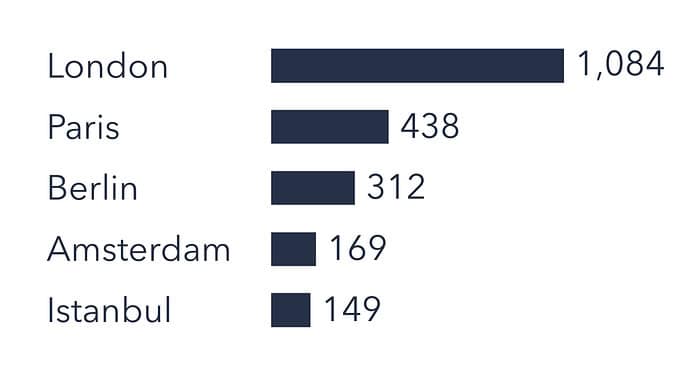

London is the European Venture Capital industry hotspot, while Paris takes the second spot

- The most investments in December were conducted in the UK (59), followed by France (57) and the Netherlands (32).

- When ranking by investment volume instead of the number of conducted investments, Paris takes first place ($650.1mn), closely followed by London ($634.4mn). Cambridge would then secure the third position with $212.0mn.

In the spotlight: Mistral AI raised $414.5mn in December in a Series A round

Company

Industry

Software, AI

Founded in

2023, Paris (FR)

One-Sentence-Pitch

Mistral AI is a developer of an open-source platform that assembles team to develop the generative AI models.

Financing round

Money raised

$415mn

Company valuation

~$2bn

Type of financing round

Series A round

Comment/Quote

Following a Seed Round of $112mn seed round, Mistral AI raised a $415mn Series A Round, valuing the company at roughly $2bn. Co-founded by Google’s DeepMind and Meta alums, Mistral AI is working on foundational models with an open technology angle.

Investors

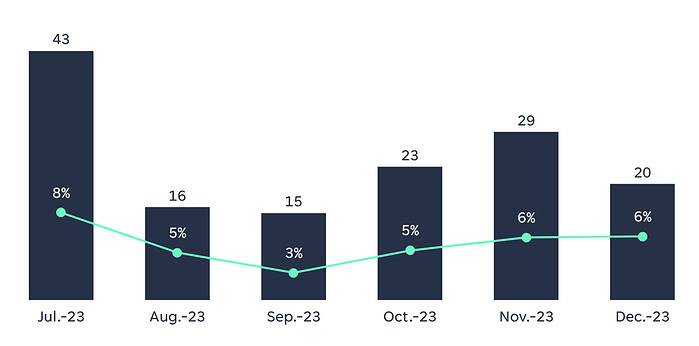

Number of PE acquisitions decreased by 31% after an increase from September to December

Number of PE acquisitions increases compared to VC investments

- In December, 20 PE acquisitions were conducted, representing a share of about 6% of all investment rounds (VC + PE) in December (307).

- The relation of acquisitions to investments increased for the third time in a row since the low of 3% in September.

- With a total of 3 acquisitions, the most companies during the month of December were acquired in London.

Highlight of European PE acquisitions in December

Largest known acquisition – $1.6bn

Aquirer

(US-based alternative asset manager)

Acquiree

(UK-based provider of multi-utility infrastructure connections)

2023 Recap

In 2023, a total of 6,604 VC investments were conducted, raising a total volume of $43.9bn.

Total number and volumes of monthly investments in 2023

Most companies raised seed rounds in 2023

Most active VC cities

Most active VC investors

Largest round of 2023 raised $2.15bn

Verkor has closed the largest financing round in 2023

On September 14, Verkor secured $2.15bn to launch a high-performance battery gigafactory in France and accelerate future sustainable mobility. The largest equity raise for a French start-up. Verkor is a battery cell manufacturer whose goal is to increase the production of low-carbon batteries to fulfill the growing demand for electric vehicles.

Partner with us

Unlock the full potential of your financial strategy with Trustventure’s expert guidance. Whether you’re navigating challenges in the financial sector, seeking advice on corporate financing, or enhancing your planning and controlling processes, we’re here to empower your journey and help you create transparency and confidence for both you and your investors.

Ready to elevate your financial game? Reach out to us today using our contact form or drop us a direct message at office@trustventure.de. Work with us to achieve your financial success!