Number and amounts of announced funding rounds over the past 6 months*

(1) All data from crunchbase, as of February 5, 2024

AI startups take the second place for the most popular investment industry

- During January, 427 financing rounds were announced.

- The total amount invested in the announced financing rounds was $4.9bn, increasing by 58% compared to the previous month.

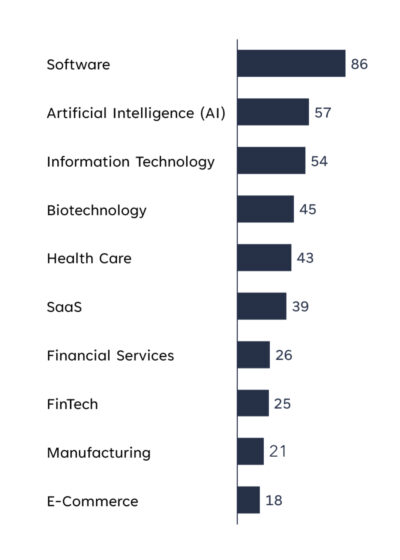

- Similar to previous months, most investments were made in Software companies, amounting to 86 investments. Investments in AI (57) take second place in front of IT startups.

Top 10 industries of financed startups according to the number of conducted investments

Bpifrance is once again the most active VC investor

Investors with the highest number of investments in January

Number and total volume of financing rounds per stage

The largest round of January was a Venture Round of $388.5mn

In January, most investment rounds were Seed Rounds (~38%). Despite that, the largest volume of $1.6bn was invested in 89 Venture Rounds, closely followed by $1.5bn invested in only 31 Series B rounds.

London is the European venture capital industry hotspot, while Paris takes the second spot; Berlin places third by number of investments

- By far, the most investments in January were conducted in the UK (108), followed by France (45) and Germany (43).

- When ranking by investment volume instead of the number of conducted investments, London ($812mn) and Paris ($569mn) would keep their positions. However, Stockholm ($511mn), Amsterdam ($396mn), and Milano ($237mn) would follow in positions 3 to 5.

In the spotlight: Picnic raised €355mn in January in a venture round

Company

Industry

Consumer Goods, Delivery Service

Founded in

2015, Amsterdam (NL)

One-Sentence-Pitch

Picnic is a fast-growing tech company that has developed a mass-market home delivery system for fast-moving consumer goods.

Financing round

Money raised

$388mn (€355mn)

Type of financing round

Venture Round

Comment/Quote

“Dutch online grocery store Picnic raised €355 million in investor capital as part of plans to expand its presence in France and Germany. […] It has raised over €1.3 billion in funding and operates in over 200 cities spanning the Netherlands, Germany, and France.” – tech.eu

Investors

After a decline during the late summer, the number of PE acquisitions is on the rise again

The number of PE acquisitions increases similarly to VC investments

- In January, 25 PE acquisitions were announced, representing a share of about 6% of all investment rounds (VC + PE) in January (452).

- The relation of acquisitions to investments slightly increased again, following a decline to 5% in December 2023.

- Xenon Private Equity acquired the three companies of Kettydo+, UrbiStat, and HicMobile.

Highlight of European PE acquisitions in January

Largest known acquisition – €600mn

Aquirer

(PE based in Luxembourg)

Acquiree

(Italian quick-service restaurant chain)

Partner with us

Unlock the full potential of your financial strategy with Trustventure’s expert guidance. Whether you’re navigating challenges in the financial sector, seeking advice on corporate financing, or enhancing your planning and controlling processes, we’re here to empower your journey and help you create transparency and confidence for you and your investors.

Ready to elevate your financial game? Reach out to us today using our contact form or drop us a direct message at office@trustventure.de. Work with us to achieve your financial success! 🚀