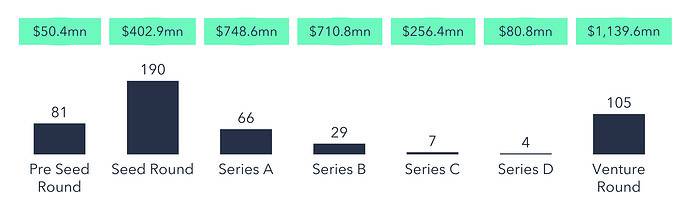

Number and amounts of announced funding rounds over the past 6 months*

* All data from crunchbase, as of April 3rd, 2023

Software startups are once again the most popular investments

- During the month of March, 482 financing rounds were announced.

- Parallel to the number of announced investments, the total amount invested also increased to $3.4bn from $3.2bn in February.

- Once again, most investments were made in Software companies, amounting to 120 investments, followed by information technology (77). In March, investments in AI companies make up the third place (50).

Top 10 industries of financed startups according to the number of conducted investments

The HTFG is the most active investor of march; 190 seed rounds were conducted

Investors with the highest number of investments in March

Number and total volume of financing rounds per stage

Largest round was a Series B Round of $109.3mn

In March, most investments (~39%) rounds were Seed Rounds. Despite that, the largest volume of invested money was in 105 Venture Rounds ($1,139.6mn).

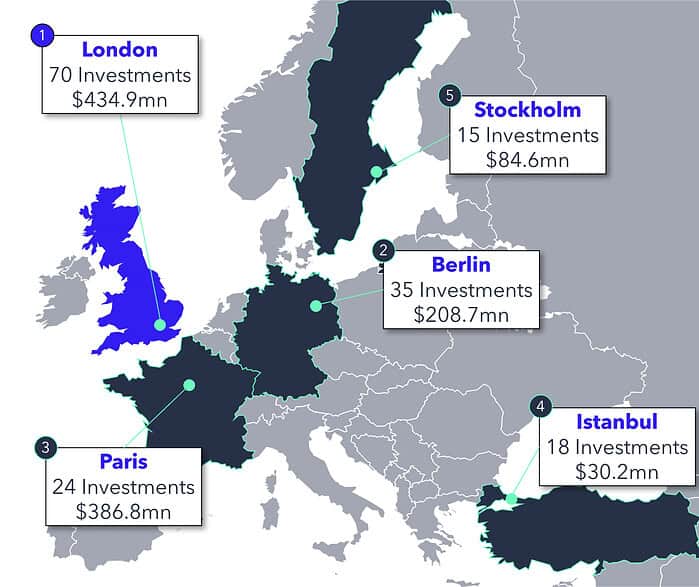

London, UK, is once again the European startup hotspot of the month

- Not only were the most investments conducted in the UK (#107), but the highest volume was also invested there during March ($434.9mn).

- Switzerland (32 investments, $307.1mn) and Spain

(31 investments, $170.9mn) place on fourth and fifth place for the ranking of most active VC countries of Europe.

In the spotlight: Noema Pharma raised $109.3mn in march with the help of 7 investors.

Company

Industry

Biotechnology/Medical

Founded in

2019, Basel

One-Sentence-Pitch

Noema Pharma is a biotech company that develops therapies to address disabling symptoms in conditions of the brain and nervous system.

Financing round

Money raised

$109.3mn (CHF103.0mn)

Type of financing round

Series B

Comment/Quote

After a Series A round of $60mn (CHF54mn) at the end of 2020, Noema Pharma was able to raise a Series B round with the support of 4 existing and 3 new investors. The funds will be mainly used for further clinical testing. (noemapharma.com)

Investors

Partner with us

Unlock the full potential of your financial strategy with Trustventure’s expert guidance. Whether you’re navigating challenges in the financial sector, seeking advice on corporate financing, or enhancing your planning and controlling processes, we’re here to empower your journey and help you create transparency and confidence for both you and your investors.

Ready to elevate your financial game? Reach out to us today using our contact form or drop us a direct message at office@trustventure.de. Work with us to achieve your financial success!