Number and amounts of announced funding rounds over the past 6 months*

* (1) All data from crunchbase, as of July 3rd, 2023

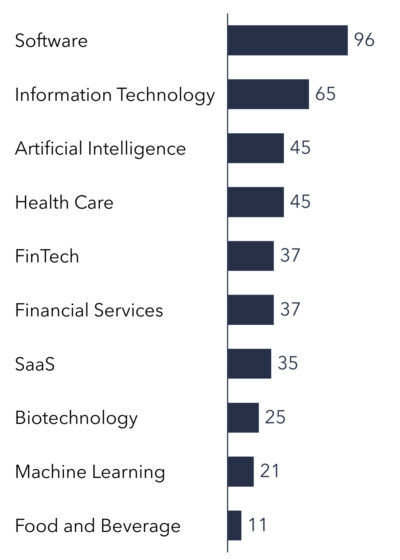

AI and Health Care startups share 3. place for most popular investment industry

- During the month of June, 441 financing rounds were announced.

- The total amount invested in the announced financing rounds decreased slightly to $3.3bn.

- Last month, less than 100 investments were made in Software companies, which still take the lead. In June they were followed by investments in information technology (65), AI and Health Care (each 45) startups.

Top 10 industries of financed startups according to the number of conducted investments

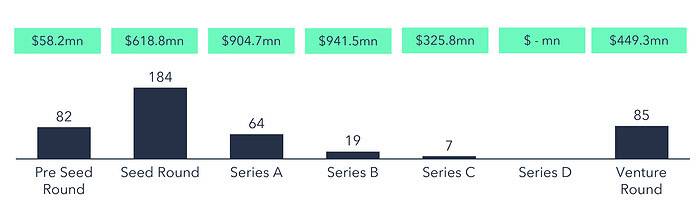

Bpifrance is the most active investor of june; no series D round was conducted

Investors with the highest number of investments in June

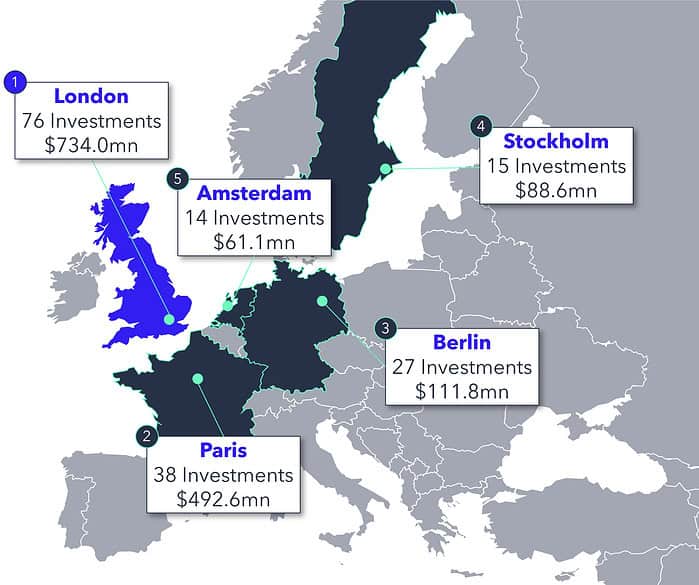

Number and total volume of financing rounds per stage

Largest round of June was a Series D Round of $469.4mn

In June, most investments rounds were Seed Rounds (~41.7%). Despite that, a volume of over $941mn was invested in only 19 Series B Rounds, driven by the largest round of $469.4mn.

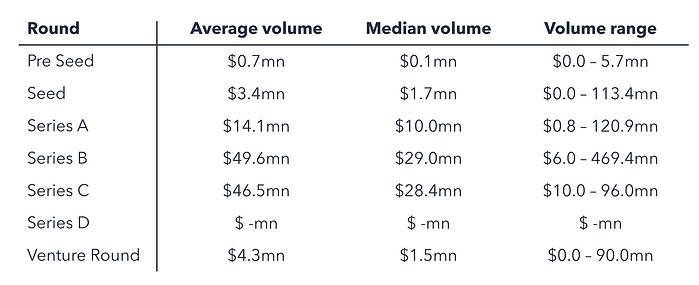

London, UK, is once again the European startup hotspot of the month with 76 investments and $734mn invested capital

- Not only were the most investments conducted in the UK (#114), but the highest volume was also invested there during June ($881.7mn).

- While Berlin takes the third place in the city ranking, based on the number of investments, Hamburg takes the third place based on invested volume with $470.6mn invested capital, driven by the 1KOMMA5° Series B Round.

In the spotlight: 1Komma5° raised $469.4mn in June in a series B funding round

Company

Industry

Renewable Energy/Climate Tech

Founded in

2021, Hamburg

One-Sentence-Pitch

1Komma5°is an electricity company offering solar panels, wall box chargers, heat pumps and a smart energy management tool.

Financing round

Money raised

€430.0mn ($469.4mn)

Company valuation

> €1.0bn

Type of financing round

Series B

Comment/Quote

1KOMMA5° has raised €430mn in funding, comprised of €215mn in equity and €215mn in buyback options, less than two years after its foundation. With this round, the startup is therefore joining the club of tech unicorns. (techstartups.com)

Investors

Additional highlight: mistral ai raises €105.0, just weeks after being founded

Company

Industry

Artificial Intelligence

Founded in

2023, Paris

One-Sentence-Pitch

Mistral AI is a platform that currently still assembles a team to develop generative AI models, planning to launch a large language model in early 2024.

Financing round

Money raised

€105.0mn ($113.4mn)

Company valuation

€135.0mn (Pre-Money)

Type of financing round

Seed

Comment/Quote

Mistral AI raised a Seed Round of €105.0mn, just one month after being founded by three former Meta and Google AI researchers in Paris. A total of 15 VC firms and business angels invested in the company. (reuters.com)

Investors

Partner with us

Unlock the full potential of your financial strategy with Trustventure’s expert guidance. Whether you’re navigating challenges in the financial sector, seeking advice on corporate financing, or enhancing your planning and controlling processes, we’re here to empower your journey and help you create transparency and confidence for both you and your investors.

Ready to elevate your financial game? Reach out to us today using our contact form or drop us a direct message at office@trustventure.de. Work with us to achieve your financial success!