Number and amounts of announced funding rounds over the past 6 months*

* All data from crunchbase, as of May 2nd, 2023

Software startups are once again the most popular investments

- During the month of April, 435 financing rounds were announced.

- The total amount invested in the announced financing rounds decreased to $3.0bn from $4.4bn in March.

- Once again, most investments were made in Software companies, amounting to 99 investments, followed by information technology (68). In April, investments in health care companies make up the third place (42).

Top 10 industries of financed startups according to the number of conducted investments

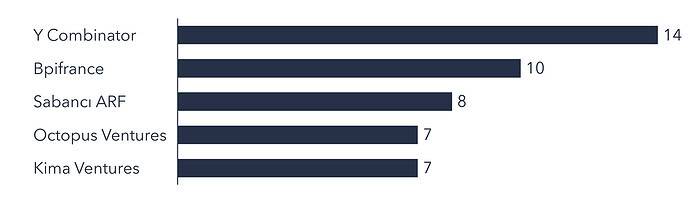

Y Combinator is the most active investor of April; 178 seed rounds were conducted

Investors with the highest number of investments in April

Number and total volume of financing rounds per stage

Largest round of April was a Series D Round of $175.5mn

In April, most investments rounds were Seed Rounds (~41%). Despite that, the largest volume of invested money was in 87 Venture Rounds ($819.9mn).

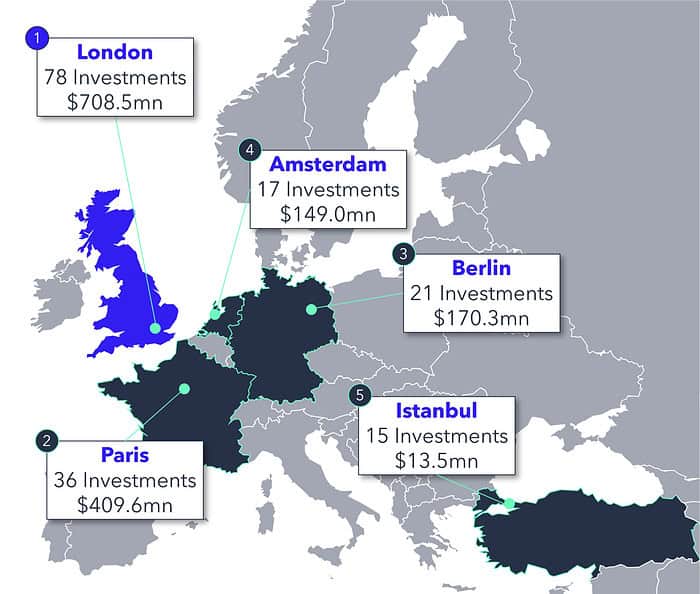

London is the European Venture Capital industry hotspot, with more than 2x investments than Paris

- Not only were the most investments conducted in the UK (#120), but the highest volume was also invested there during April ($932.2mn).

- France takes the second place in the country ranking for the number of investments (#61) as well as for the invested volume ($648.2).

In the spotlight: Ynsect raised $175.5mn in April in their 12th conducted funding round

Company

Industry

Agriculture/Biotechnology

Founded in

2011, Paris

One-Sentence-Pitch

Ynsect provides products and services that operate in the agro-food and environmental biotech industries.

Financing round

Money raised

$175.5mn / €160mn

Type of financing round

Series D

Comment/Quote

(The company) is shifting away from animal feed (…) to high-margin pet food and food ingredients to boost profit amid soaring energy, raw materials and debt costs. (…) It’s seeking to follow an “asset-light,” less capital-intensive business model with a combination of joint ventures and licensing agreements.

Investors

Partner with us

Unlock the full potential of your financial strategy with Trustventure’s expert guidance. Whether you’re navigating challenges in the financial sector, seeking advice on corporate financing, or enhancing your planning and controlling processes, we’re here to empower your journey and help you create transparency and confidence for both you and your investors.

Ready to elevate your financial game? Reach out to us today using our contact form or drop us a direct message at office@trustventure.de. Work with us to achieve your financial success!