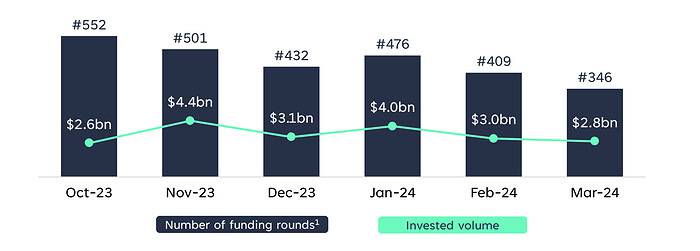

Invested VC volume decreased by 7% in March compared to the previous month

Number and amounts of announced funding rounds over the past 6 months*

(1) All data from CrunchBase, as of April 3, 2024

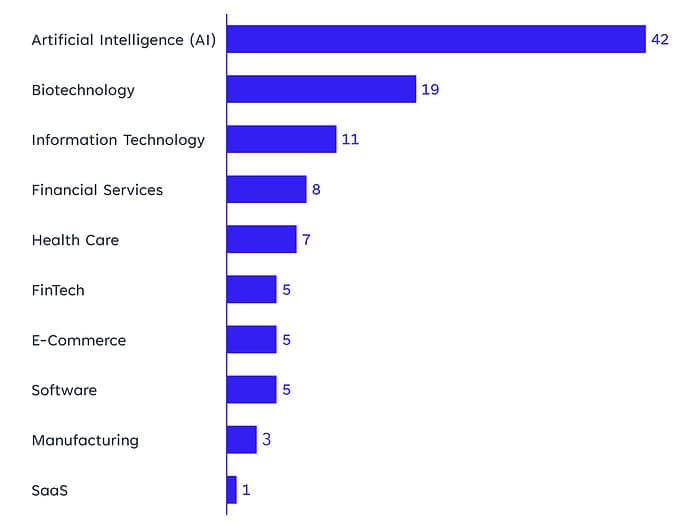

The AI trend is reflected in the 1st place for AI startups, totaling 42 investments. Followed by BioTech startups (19).

- During March, 346 financing rounds were announced.

- The total amount invested in the announced financing rounds was $2.8bn, a 7% decrease since last month.

- Most investments were made in AI businesses, amounting to 42 investments. Investments in Biotechnology (19) take second place in front of IT companies (11).

Top 10 industries of financed startups according to the number of conducted investments

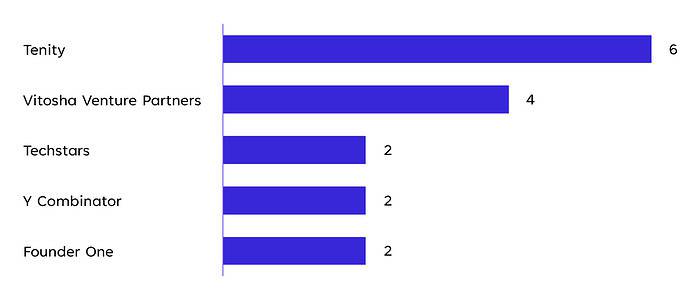

Tenity was the most active VC investor

Investors with the highest number of investments in March

Number and total volume of financing rounds per stage

The largest round of March was a Venture round of $430.0mn

In March, most investment rounds were Seed Rounds (~41%). Despite that, the largest volume of $920mn was invested in only 71 Venture Rounds.

London is the European VC industry hotspot, while Paris takes the 2nd spot

- The most investments in March were conducted in the UK (100), followed by Germany (41) and France (33).

- When ranking by investment volume instead of the number of conducted investments, London, Paris, and Berlin maintain their positions as first to third, respectively. However, Munich ($154mn) would take 4th place.

In the spotlight

Largest Round: Monzo raised $430mn in a late-stage round

Financing round

Money raised

$5bn

Type of financing round

Late-stage round

Comment/Quote

Investors

Largest Seed-Round: Relation Therapeutics raised $35mn

Company

Industry

Founded in

2019, London

One-Sentence-Pitch

Relation Therapeutics is a biotechnology company that focuses on humanizing drug discovery and development.

Financing round

Money raised

$35mn

Type of financing round

Seed-Round

Comment/Quote

“This new capital allows us to accelerate our discovery of novel biology, targets, and medicines: we are immensely excited about our progress and the impact we can make for patients,” – David Roblin, CEO of Relation Therapeutics.

Investors

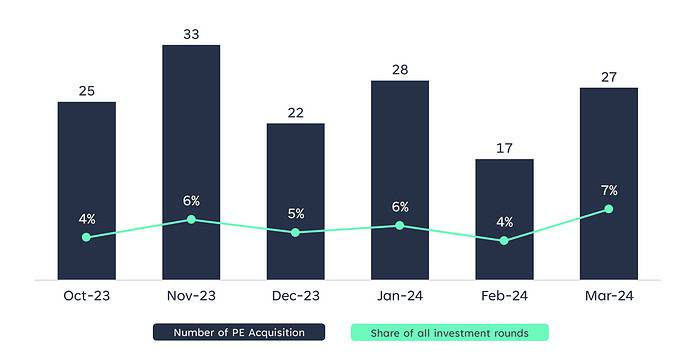

The number of PE acquisitions is on the rise again after a decline in February

The number of PE acquisitions increases compared to VC investments

- In March, 27 PE acquisitions were conducted, representing a share of about 7% of all investment rounds (VC + PE) in March (372).

- The ratio of acquisitions to investments increased in March and is at its highest in the last 6 months, reaching 7%.

- With a total of 3 acquisitions, the most companies during March were acquired in London.

Highlight of European PE acquisitions in February

Largest known acquisition – $4.9bn

Aquirer

(London-based PE investment house)

Acquiree

(Provider of fund and corporate services)

Partner with us

Unlock the full potential of your financial strategy with Trustventure’s expert guidance. Whether you’re navigating challenges in the financial sector, seeking advice on corporate financing, or enhancing your planning and controlling processes, we’re here to empower your journey and help you create transparency and confidence for you and your investors.

Ready to elevate your financial game? Reach out to us today using our contact form or drop us a direct message at office@trustventure.de. Work with us to achieve your financial success! 🚀