Proxima Fusion has raised €20mn in seed funding to propel towards building the first generation of fusion power plants based on quasi-isodynamic (QI) stellarators with high-temperature superconductors.

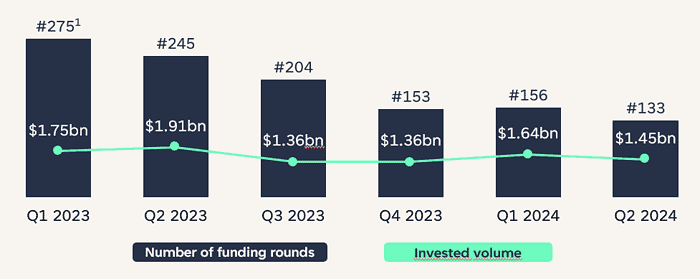

Invested VC volume decreased by 24% in Q2 2024 compared to Q2 2023 Germany VC + PE Landscape – Q1 2024

Number and amounts of announced funding rounds over the past quarters*

* All data from CrunchBase, as of July 3, 2024

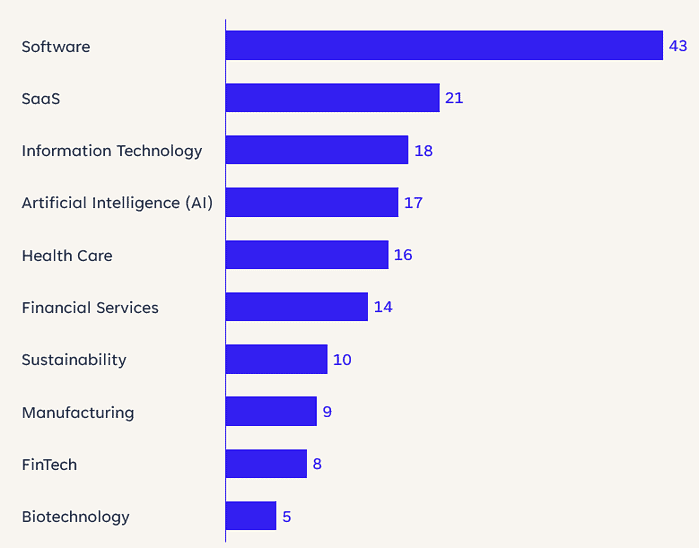

In Q2, the software industry saw the most investments (43), followed by SaaS startups (21) and IT startups (18).

- A total of 133 financing rounds were announced. Germany VC + PE Landscape – Q1 2024

- The total amount invested in the announced financing rounds was $1.45bn, a 24% decrease compared to Q2 2023.

- Most investments were made in Software businesses, amounting to 43 investments.

Top 10 industries of financed startups according to the number of conducted investments

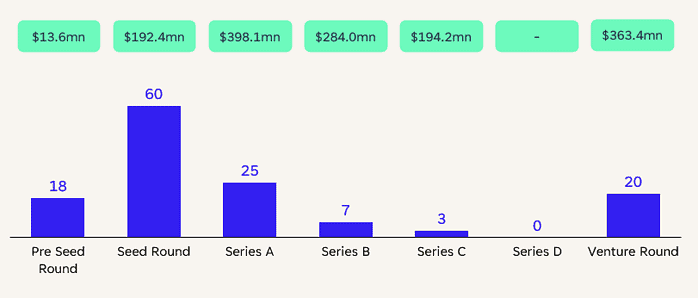

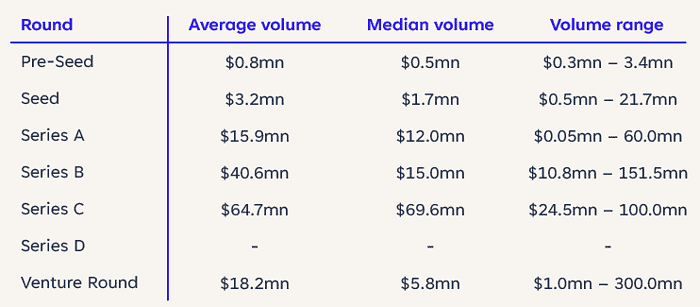

Number and total volume of financing rounds per stage

The largest round of Q2 2024 was a Venture Round of $300mn

In Q2, most investment rounds were Seed Rounds (~45%). Despite that, the largest volume of $398mn was invested in only 25 Series A Rounds.

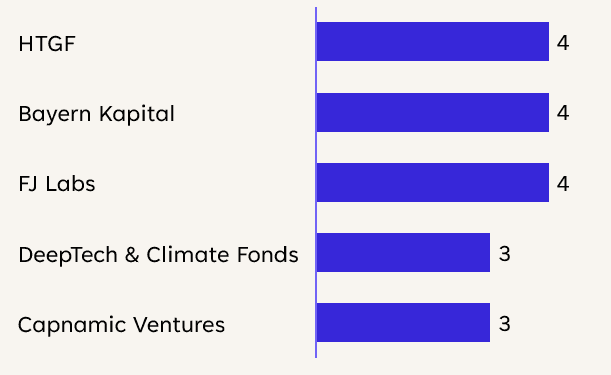

HTGF, Bayern Kapital and FJ Labs were the most active VC investors in Germany Germany VC + PE Landscape – Q2 2024

Investors with the highest number of investments in Q2 2024 Germany VC + PE Landscape – Q1 2024

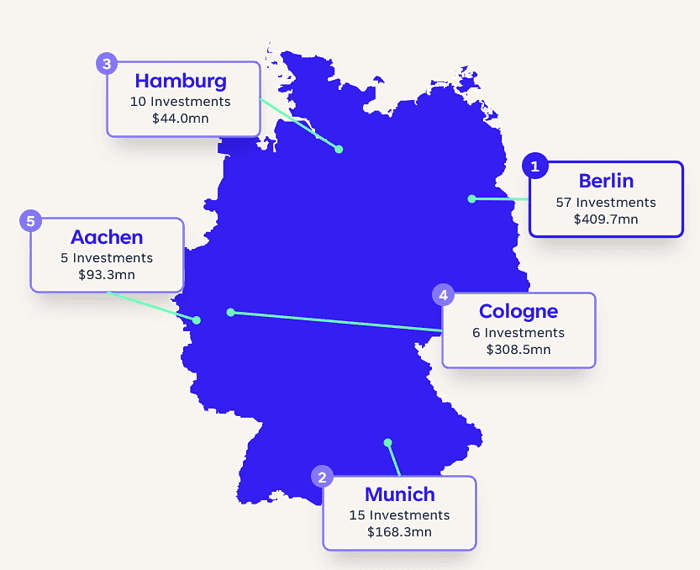

Berlin is Germany’s VC hotspot, while Munich takes the 2nd spot

- The most investments in Q2 were conducted in Berlin (57), followed by Munich (15) and Hamburg (10).

- When ranking by investment volume instead of the number of conducted investments, Leipzig ($151.5mn) and Düsseldorf ($104.1mn) push Hamburg and Aachen out of the Top 5.

In the spotlight

Munich raised the largest Seed-Round in Germany in Q2

Munich at a glance*

- 2.2k+ Startups

- 220+ VC Investors

- 2.8k+ Funding Rounds

- 58k+ Startup Employees

*Munich Startup

Largest Seed-Round: Proxima Fusion raised €20mn

Industry

Energy, Power Grid

Founded in

2023, Munich

Money raised

$02mn

Type of financing round

Seed-Round

Comment/Quote

Investors

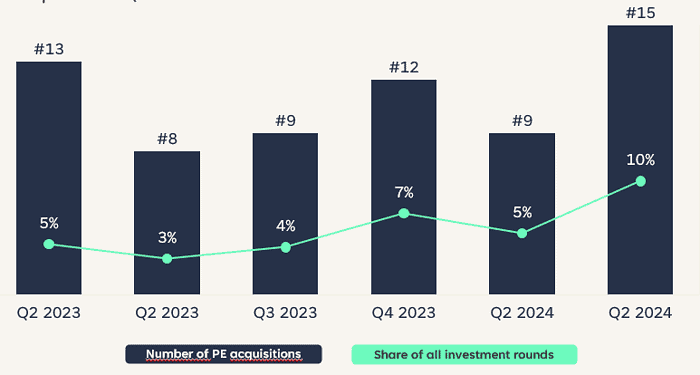

Private equity acquisitions increased by 88% compared to the previous year

Number of PE acquisitions compared to VC investments increased significantly

- In Q2 2024, 15 PE acquisitions were conducted in Germany, representing a share of 10% of all investment rounds (VC + PE) in Q2 (148).

- The ratio of PE acquisitions to VC investments has more than tripled compared to the same period last year, reaching its highest point in the last six quarters.

Partner with us

Unlock the full potential of your financial strategy with Trustventure’s expert guidance. Whether you’re navigating challenges in the financial sector, seeking advice on corporate financing, or enhancing your planning and controlling processes, we’re here to empower your journey and help you create transparency and confidence for you and your investors.

Ready to elevate your financial game? Reach out to us today using our contact form or drop us a direct message at office@trustventure.de. Work with us to achieve your financial success! 🚀