January saw 349 VC investments across Europe, with $4.5bn invested in total. While the number of investments declined by 43% year-over-year, the investment volume remained almost constant.

Number and volume of announced funding rounds over the past 12 months*

- Number of funding rounds

- Invested volume in $bn

Leader Industries and Investors

According to the number of conducted investments, the Health Care startups lead the market with a total of 96 investments in the broader industry. AI startups secured the second spot with 81 investments, closely followed by FinTech startups (79).

Regarding the investors behind those funding rounds, Decelera and Novo Holdings emerged as the most active VC investors, completing 7 deals each. With this, the two VCs leads ahead of Bpifrance (5 deals), Fuel Ventures (5 deals) and Lakestar (4 deals) among the top 5.

Top 10 Industries of Financed Startups

- Health Care

- AI

- FinTech

- Energy

- BioTech

- Manufacturing

- Marketing

- Web

- Consulting

- Retail

Top 5 Investors with the highest number of deals

- Decelera

- Novo Holdings

- Bpifrance

- Fuel Ventures

- Lakestar

Notable funding rounds across Europe

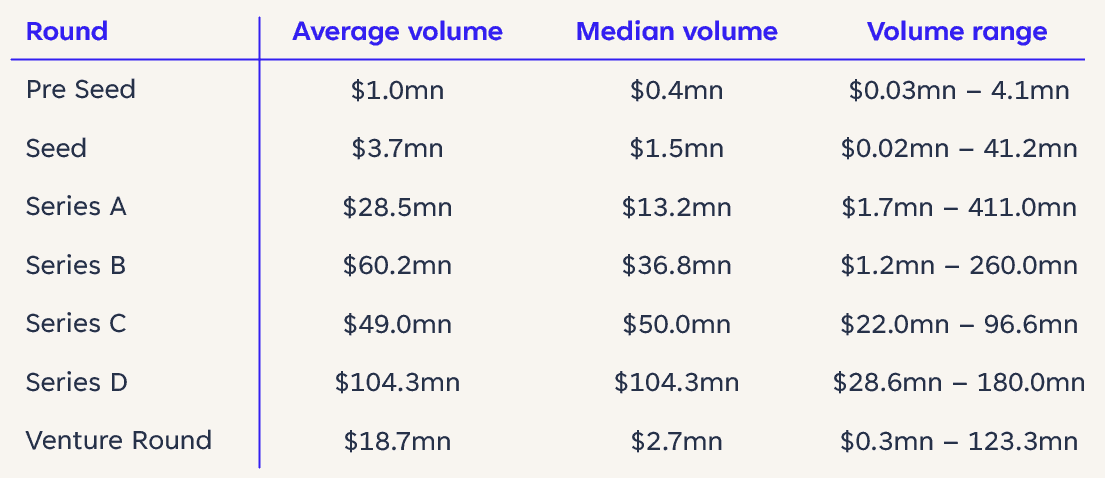

In January, the largest funding round was a $411 million Series A Round secured by Verdiva Bio, a startup creating cutting-edge treatments that improve results for patients with obesity and cardiometabolic diseases. The company was founded in 2024 in London.

While Seed Rounds accounted for a major part of investment rounds, making up approximately 39% of the total rounds, the highest investment volume was seen in Series A Rounds, which accounted for $1.6 billion across 56 deals.

The largest Seed Round was secured by Xcalibur, which raised $41.2 million. Founded in Madrid in 2021, the startup provides natural resource mapping services for the airborne and geophysics industries.

Number and total volume of financing rounds per stage

- Number of funding rounds per stage

- Volume of financing rounds per stage in $mn

Detailed overview by stage

European VC Industry Hotspots

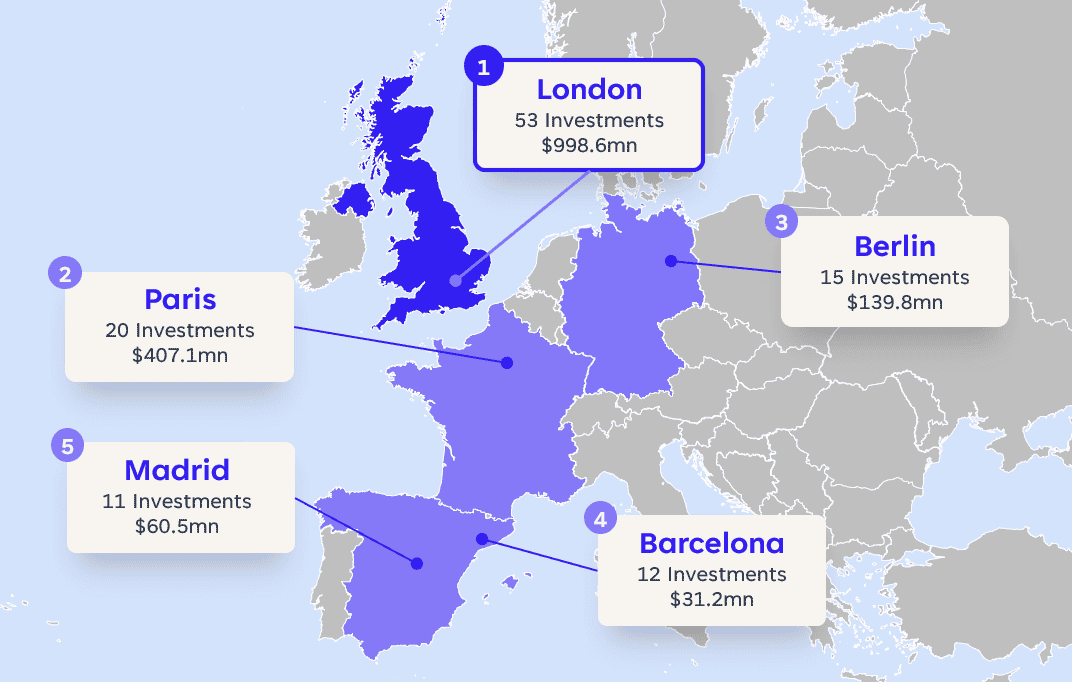

When ranking by the number of conducted investments, London remains the hotspot of the European VC industry in January, with Paris securing the second spot.

During January, the UK led the way with the most investment rounds at 88, followed by France with 41. Germany takes a close third spot with 39 investments.

When ranking the cities by investment volume rather than the number of investments, Stockholm ($296.0mn), Basel ($286.0mn), and Dublin ($216.0mn) take positions 3 to 5.

PE Acquisitions Overview

Private Equity (PE) continues its uptrend against the previous year with January acquisitions increasing by 36% to 45, compared to January 2024. With 10 acquisitions, Italy saw the highest number of companies acquired while manufacturing dominated as the top PE industry with with 11 acquisitions.

The Private Equity share as part of the total 394 investment rounds in January (VC + PE) doubled compared to the same time last year, reaching 10% .

The largest known acquisition was Brookfield’s acquisition of Chemelex, a Barcelona-based chemicals provider for laboratory disease detection, for $1.7 billion.

- % of all investment rounds

- Number of PE acquisitions

*All data from CrunchBase, as of February 4, 2025.

Partner with us

Unlock the full potential of your financial strategy with Trustventure’s expert guidance. Whether you’re navigating challenges in the financial sector, seeking advice on corporate financing, or enhancing your planning and controlling processes, we’re here to empower your journey and help you create transparency and confidence for you and your investors.

Ready to elevate your financial game? Reach out to us today using our contact form or drop us a direct message at office@trustventure.de. Work with us to achieve your financial success! 🚀