Last month saw 188 VC investments across Europe, with $1.5bn invested in total – a 46% drop in funding volume compared to July last year.

Number and volume of announced funding rounds over the past 12 months*

- Number of funding rounds

- Invested volume in $bn

Leading Industries and Investors

According to the number of conducted investments, AI leads with 58 rounds, followed by Health Care with 40 and FinTech with 38, each ahead by a significant margin of the next industry, Marketing (17).

Tenity was the most active investor in August with 9 announced investments. Norrsken Evolve and EIFO followed with 6 each, then HTGF with 4, and LvlUp Ventures with 3, rounding out the top five most active investors.

Top 10 Industries of Financed Startups

- AI

- Health Care

- FinTech

- Marketing

- Energy

- Web

- Food and Beverage

- Manufacturing

- BioTech

- Travel

Top 5 Investors with the highest number of deals

- Tenity

- Norrsken Evolve

- EIFO

- HTGF

- LvlUp Ventures

Notable funding rounds across Europe

In August, the largest funding round was a $175 million Venture Round by Aira, a Stockholm-based clean energy-tech company providing heat pumps and home energy-saving solutions. Founded in 2022 in Sweden, Aira raised the investment to expand its clean energy and heating solutions.

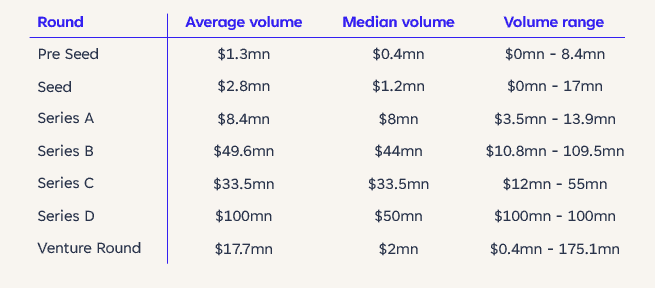

While Seed Rounds made up the largest share of rounds (36%), the highest investment volume was in Series B rounds, which accounted for $546 million across 11 deals.

The largest Seed Round was secured by Phoebe, a London-based agentic search tool for tech stack data. Founded in 2024 in the UK, Phoebe raised $17 million (€15 million) in August.

Number and total volume of financing rounds per stage

- Number of funding rounds per stage

- Volume of financing rounds per stage in $mn

Detailed overview by stage

European VC Industry Hotspots

In August, London remained the leading hotspot for European VC by number of investments (35), followed by Zurich (8), Copenhagen (7), Tallinn (7), and Berlin (6).

The most investments by country were in the UK (57), followed by Switzerland (18) and Germany (16).

When ranked by investment volume instead of deal count, Stockholm ($187 million across 5 deals), Mont-Saint-Guibert ($110 million across 1 deal), Amsterdam ($101 million across 4 deals), and Dublin ($92 million across 3 deals) join London in the top five cities by volume.

VC Exit Overview

In August, 33 exits took place. As in July, there were no IPOs during the month.

With 10 exits each, AI and FinTech companies were the largest exit industries, followed by Health Care (7) and Web (6) companies.

Most companies exited in the UK with 13 exits, followed by 4 companies in Germany.

- Number of Acquisition Exits

- Number of IPO Exits

PE Acquisitions Overview

In August, 25 PE acquisitions (12% of all VC and PE investment rounds) were conducted, a decrease of 1% compared to last month.

With 7 acquisitions, the UK saw the highest number of companies acquired in August.

Health Care (9), Manufacturing (5) and FinTech (5) were the top acquisition industries mentioned.

The standout deal was Apollo’s €2 billion acquisition of Kelvion, a globally active manufacturer of industrial heat exchangers for various markets.

- % of all investment rounds

- Number of PE acquisitions

*All data from CrunchBase, as of September 4, 2025.

Partner with us

Unlock the full potential of your financial strategy with Trustventure’s expert guidance. Whether you’re navigating challenges in the financial sector, seeking advice on corporate financing, or enhancing your planning and controlling processes, we’re here to empower your journey and help you create transparency and confidence for you and your investors.

Ready to elevate your financial game? Reach out to us today using our contact form or drop us a direct message at office@trustventure.de. Work with us to achieve your financial success! 🚀