In June, the volume of invested venture capital in Europe saw a 5% decrease compared to May, according to Crunchbase data. The total of invested volume reached $5.2 billion, spread across 409 funding rounds.

Number and volume of announced funding rounds over the past 12 months*

- Number of funding rounds

- Invested volume in $bn

Leader Industries and Investors

According to the number of conducted investments, the software startups lead the market with a total of 86 investments. The AI trend persists, with 50 investments being made in AI startups this month, thus capturing the spot of second most invested industry, followed by IT startups on the third spot.

Now, regarding the companies behind the investments, Seraphim Space emerged this month as the most active venture capital investor, completing a total of 6 deals. Seraphim Space is a global investor specialising in SpaceTech with a growth fund, a venture fund and an early-stage space focused accelerator.

The second place is shared by Business Growth Fund and GEM Capital, with 3 closed deals each.

Top 10 Industries of Financed Startups

- Software

- AI

- IT

- SaaS

- Manufacturing

- FinTech

- Financial Services

- Health Care

- BioTech

- Medical

Top 5 Investors with the highest number of deals

- Seraphim Space

- Business Growth Fund

- GEM Capital

- Zouk Capital

- SRP

Notable funding rounds across Europe

In June, the largest funding round was a $537 million Venture Round secured by I-TRACING, a leading independent provider of cyber security services in France. The company was founded in 2005 in Paris.

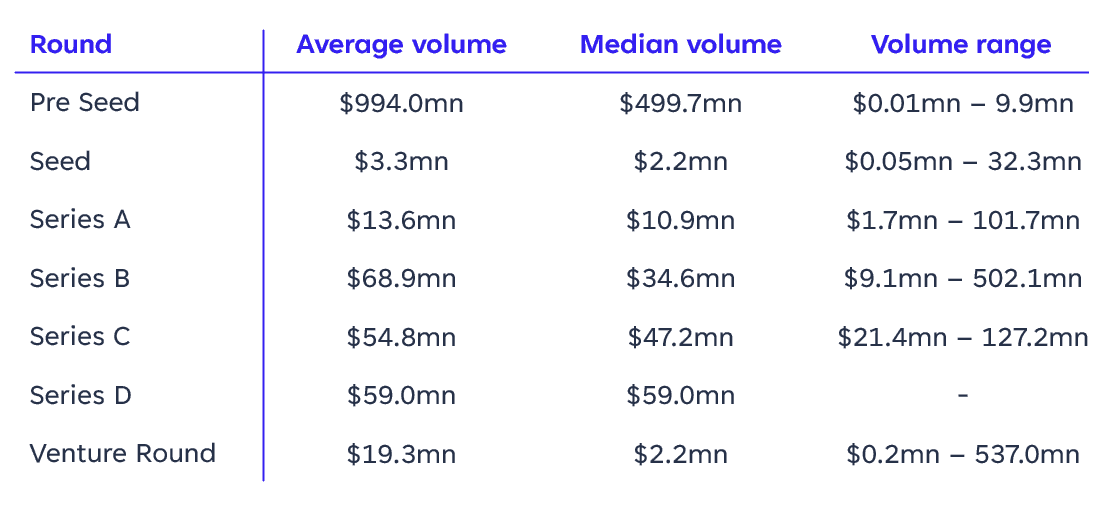

While Seed Rounds accounted for the majority of investment rounds, making up approximately 41% of the total, the highest investment volume was seen in Venture Rounds, which accounted for $1.8 billion across 91 deals.

The largest Seed Round was secured by Adcytherix, which raised $32.2 million. Founded in Marseille in 2023, Adcytherix is a biopharmaceutical firm that specializes in the development of new antibody drug conjugates (ADC). The round was led by Pontifax, a healthcare-dedicated VC firm in Israel.

Number and total volume of financing rounds per stage

- Number of funding rounds per stage

- Volume of financing rounds per stage in $mn

Detailed overview by stage

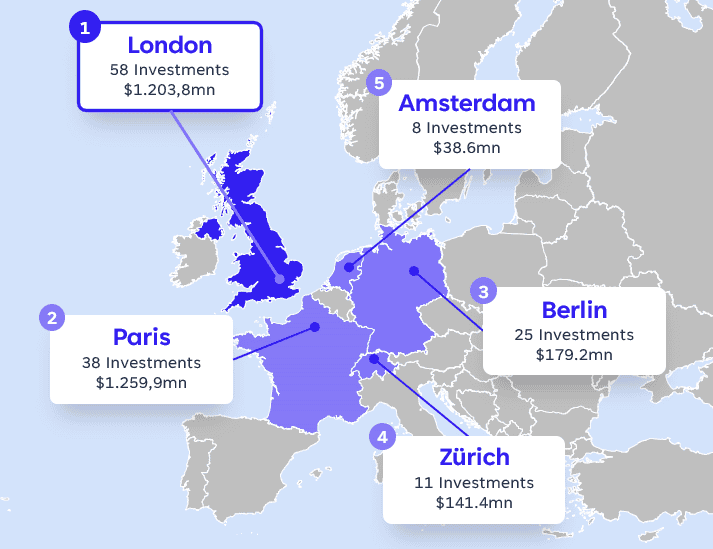

European VC Industry Hotspots

In June, London remains the hotspot of the European VC industry, with Paris securing the second spot.

As in the previous months, the UK led the way with the most investment rounds at 105, followed by France with 73, and Germany with 55.

When ranked by investment volume rather than the number of investments, Prague ($170.9mn) kicks Amsterdam out of the Top 5.

PE Acquisitions Overview

Private Equity (PE) acquisitions increased in June by 37% to 41, this marks the second highest number of acquisitions of the last twelve months. Of those 41 acquisitions, 17 included companies based in the UK, followed by Germany with 7.

With the increase in PE acquisitions, their share as part of the total 450 investment rounds in June (VC + PE) increases to 9%.

This month’s highlight is BlackRock’s acquisition of Preqin, a provider of private markets database platforms for private capital and hedge fund datasets, for $3.3 billion at the end June.

- % of all investment rounds

- Number of PE acquisitions

*All data from CrunchBase, as of July 3, 2024.

Partner with us

Unlock the full potential of your financial strategy with Trustventure’s expert guidance. Whether you’re navigating challenges in the financial sector, seeking advice on corporate financing, or enhancing your planning and controlling processes, we’re here to empower your journey and help you create transparency and confidence for you and your investors.

Ready to elevate your financial game? Reach out to us today using our contact form or drop us a direct message at office@trustventure.de. Work with us to achieve your financial success! 🚀