In October, the volume of invested venture capital in Europe saw a 41% increase compared to October 2024, according to Crunchbase data. The total of invested volume reached $3.7 billion, spread across 410 funding rounds, a slight decline in volume and funding rounds when compared to September.

Number and volume of announced funding rounds over the past 12 months*

- Number of funding rounds

- Invested volume in $bn

Leader Industries and Investors

According to the number of conducted investments, the software startups continue to lead the market with a total of 85 investments. AI startups once again secured the second spot with 59 investments, followed by IT startups (45).

Regarding the investors behind those funding rounds, UK-based ULTRA.VC emerged this month as the most active VC investor, completing 3 deals. However, the leading VC investor is closely followed by Hamamatsu Ventures, Companisto, Business Growth Fund, and Provence Business Angels among the top 5, all having closed 2 deals.

Top 10 Industries of Financed Startups

- Software

- AI

- IT

- BioTech

- Medical

- SaaS

- Health Care

- Manufacturing

- Financial Services

- FinTech

Top 5 Investors with the highest number of deals

- ULTRA.VC

- Hamamatsu Ventures

- Companisto

- Business Growth Fund

- Provence Business Angels

Notable funding rounds across Europe

In October, the largest funding round was a $110 million (€100 million) Venture Round secured by Green Genius, a green energy company that develops and operates solar, biogas, wind, hydrogen and energy storage project across Europe. The company was founded 2006 in Vilnius, Lithuania.

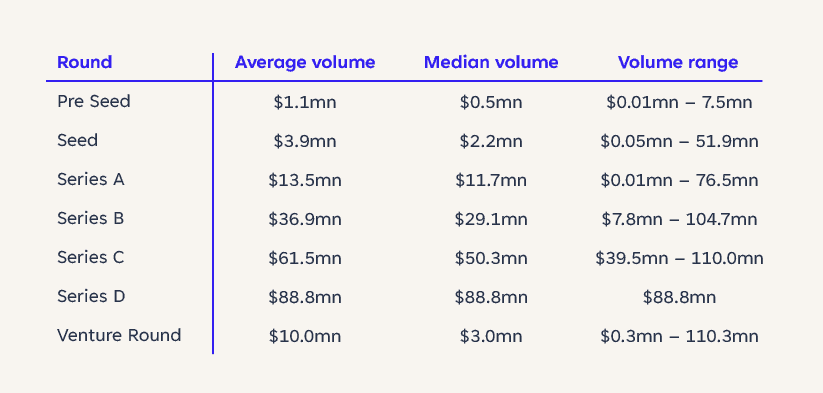

While Seed Rounds accounted for a major part of investment rounds, making up approximately 35% of the total rounds, the highest investment volume was seen in Venture Rounds, which accounted for $1.1 billion across 110 deals.

The largest Seed Round was secured by Nattergal, which raised $52.0 million (£40.0 million). Founded in Grantham, UK, in 2021, the startup buys, leases and manages degraded land- and seascapes to restore biodiversity and natural processes.

Number and total volume of financing rounds per stage

- Number of funding rounds per stage

- Volume of financing rounds per stage in $mn

Detailed overview by stage

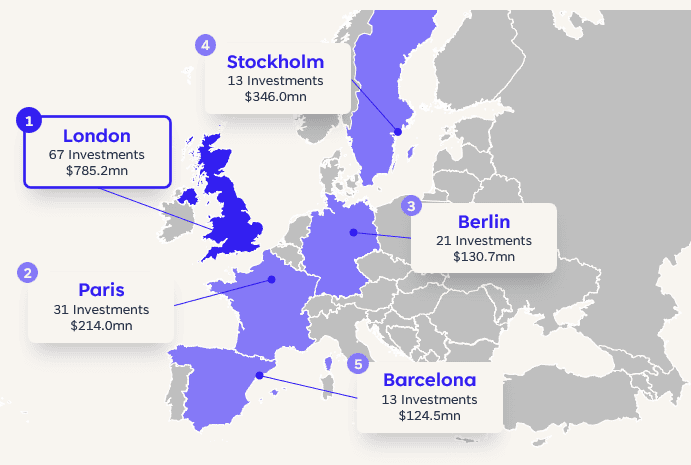

European VC Industry Hotspots

When ranking by the number of conducted investments, London remains the hotspot of the European VC industry in October, with Paris securing the second spot.

During October, the UK led the way with the most investment rounds at 112, followed by France with 57 and Germany with 46, presenting a decline across all countries compared to the previous month.

When ranked by investment volume rather than the number of investments, Vienna ($135.9 million) and Ghent ($133.6 million) replace Berlin and Barcelona in the top 5 city hotspots.

PE Acquisitions Overview

Private Equity (PE) continues its uptrend with October acquisitions increasing by 59% to 43, compared to October 2023. Of those 43 acquisitions, 10 included companies based in the UK, followed by Germany with 8 and the France with 7.

The Private Equity share as part of the total 453 investment rounds in October (VC + PE) remains at 9% from September.

The largest known acquisition was Brookfield‘s acquisition of Tritax EuroBox, a UK-based logistic real estate platform, for $1.4 billion.

- % of all investment rounds

- Number of PE acquisitions

*All data from CrunchBase, as of November 5, 2024.

Partner with us

Unlock the full potential of your financial strategy with Trustventure’s expert guidance. Whether you’re navigating challenges in the financial sector, seeking advice on corporate financing, or enhancing your planning and controlling processes, we’re here to empower your journey and help you create transparency and confidence for you and your investors.

Ready to elevate your financial game? Reach out to us today using our contact form or drop us a direct message at office@trustventure.de. Work with us to achieve your financial success! 🚀