In May, the volume of invested venture capital in Europe saw a significant increase, rising by 70% compared to April, according to Crunchbase data. The total of invested volume reached $5.5bn, spread across 344 funding rounds.

Number and volume of announced funding rounds over the past 12 months*

- Number of funding rounds

- Invested volume in $bn

Leader Industries and Investors

According to the number of conducted investments, the software startups lead the market with a total of 79 investments. The AI trend persists, with 45 investments being made in AI startups this month, thus capturing the spot of second most invested industry, followed by IT startups on the third spot.

Now, regarding the companies behind the investments, Carbon13 emerged this month as the most active venture capital investor, completing a total of 5 deals.

Carbon13 is a VC fund and venture builder focused on supporting and investing in the people and startups that build scalable climate ventures and thus will reduce and remove emissions on a global scale

In second place, with 3 closed deals, is AgFunder, a FoodTech and AgTech focused investor founded in 2013.

Top 10 Industries of Financed Startups

- Software

- AI

- IT

- Financial Services

- SaaS

- BioTech

- FinTech

- Manufacturing

- Health Care

- Medical

Top 5 Investors with the highest number of deals

- Carbon13

- AgFunder

- Farhad Farhadi

- Act Venture Capital

- SRP

Notable funding rounds across Europe

In May, the largest funding round was a $1.05 billion Series C secured by Wayve, a developer of embodied AI technology for automated driving. The AI company was founded in 2017 in London and their funding round includes noteable investors such as Softbank, Nvidia, Microsoft and Uber.

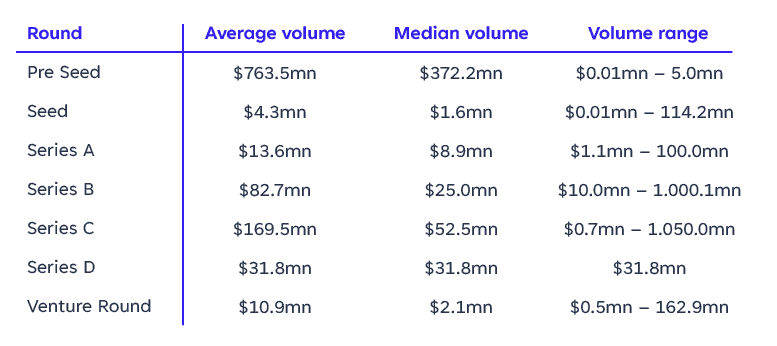

While Seed Rounds accounted for the majority of investment rounds, making up approximately 37% of the total, the highest investment volume was seen in Series B Rounds, which accounted for $1.7 billion across 21 deals.

The largest Seed Round was secured by Cloover, which raised $114.2 million. Founded in Stockholm in 2022, Cloover provides embedded financial services, software, and energy solutions to facilitate a successful energy transition. The capital was invested by QED Investors, Lower Carbon Capital and 9900 Capital.

Number and total volume of financing rounds per stage

- Number of funding rounds per stage

- Volume of financing rounds per stage in $mn

Detailed overview by stage

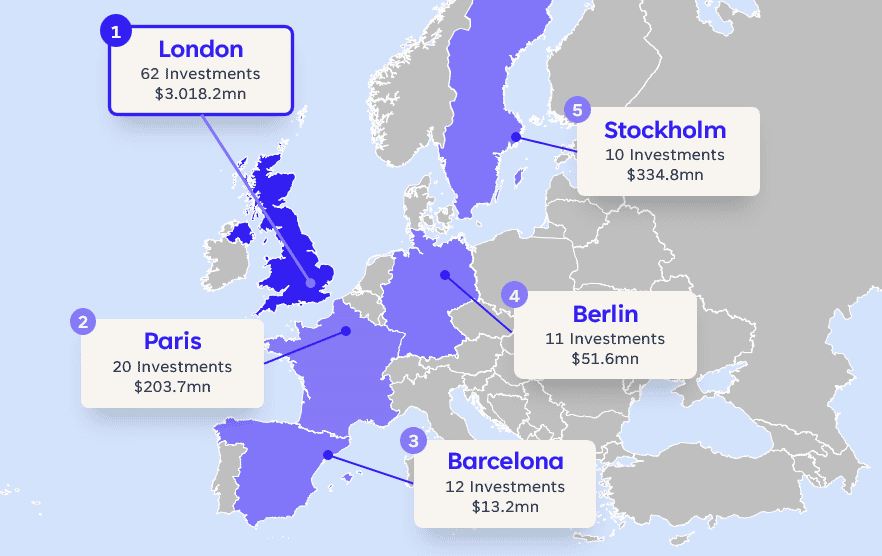

European VC Industry Hotspots

In May, London remains the hotspot of the European VC industry, with Paris securing the second spot.

As in the previous months, the UK led the way with the most investment rounds at 104, followed by France with 38, and Germany with 33. When considering investment volume rather than the number of deals, Stockholm ranks second place, followed by Cologne on the third place. Leipzig would rank fifth among the top 5 positions.

PE Acquisitions Overview

Private Equity (PE) acquisitions decreased slightly in May to 30, following the second highest number of acquisitions of the last twelve months in April. Of those 30 acquisitions, 5 included companies based in the UK and Germany each.

Following the decline in PE acquisitions, their share as part of the total 374 investment rounds in May (VC + PE) declined from 9% in April to 8%. This reflects the same level as July 2023 with the highest number of PE acquisitions in the last 12 months, showing the overall decline of European investment activity since then.

The largest known PE acquisition was conducted by RedBird IMI, a New York-based joint venture between International Media Investments and RedBird Capital Partners. All3Media, a television, filming, digital production and distribution company, was acquired for the total consideration of $1.5 billion.

- % of all investment rounds

- Number of PE acquisitions

*All data from CrunchBase, as of June 4, 2024.

Partner with us

Unlock the full potential of your financial strategy with Trustventure’s expert guidance. Whether you’re navigating challenges in the financial sector, seeking advice on corporate financing, or enhancing your planning and controlling processes, we’re here to empower your journey and help you create transparency and confidence for you and your investors.

Ready to elevate your financial game? Reach out to us today using our contact form or drop us a direct message at office@trustventure.de. Work with us to achieve your financial success! 🚀