In July, the volume of invested venture capital in Europe saw a 24% decrease compared to June, according to Crunchbase data. The total of invested volume reached $3.9 billion, spread across 387 funding rounds.

Number and volume of announced funding rounds over the past 12 months*

- Number of funding rounds

- Invested volume in $bn

Leader Industries and Investors

According to the number of conducted investments, the software startups lead the market with a total of 94 investments. The AI trend persists, with 45 investments being made in AI startups this month, thus capturing the spot of second most invested industry, equal with IT startups.

Now, regarding the companies behind the investments, EIC Accelerator and Belgium-based imec.istart emerged this month as the most active venture capital investors, completing 5 deals each.

The second place is shared by Enterprise Ireland and Business Growth Fund, with 3 closed deals each.

Top 10 Industries of Financed Startups

- Software

- AI

- IT

- Health Care

- BioTech

- FinTech

- SaaS

- Financial Services

- Medical

- Manufacturing

Top 5 Investors with the highest number of deals

- EIC Accelerator

- imec.istart

- Enterprise Ireland

- Business Growth Fund

- SRP

Notable funding rounds across Europe

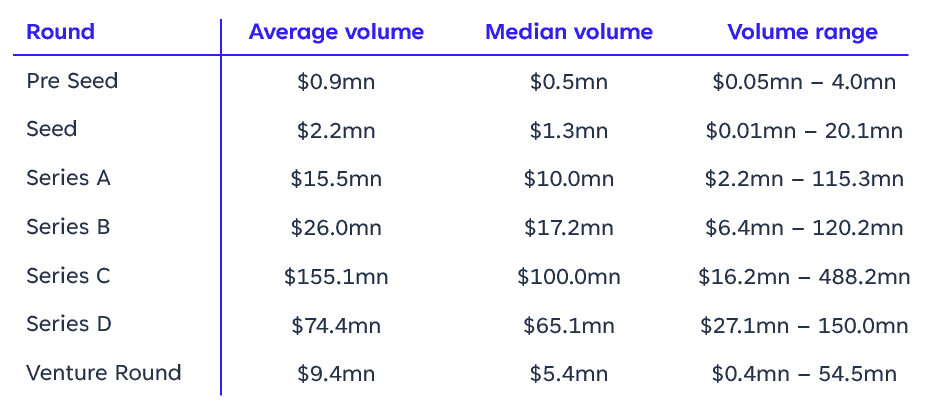

In July, the largest funding round was a $488 million Series C secured by Helsing, an AI defense company that specializes in the creation of AI-powered military solutions and components. The company was founded in 2021 in Berlin.

While Seed Rounds accounted for the majority of investment rounds, making up approximately 38% of the total, the highest investment volume was seen in Venture Rounds, which accounted for $1.1 billion across 75 deals.

The largest Seed Round was secured by Invert, which raised $20.1 million. Founded in Copenhagen in 2021, Invert is a SaaS-Startup offering a data analysis platform for bioprocess data. The investors remained undisclosed.

Number and total volume of financing rounds per stage

- Number of funding rounds per stage

- Volume of financing rounds per stage in $mn

Detailed overview by stage

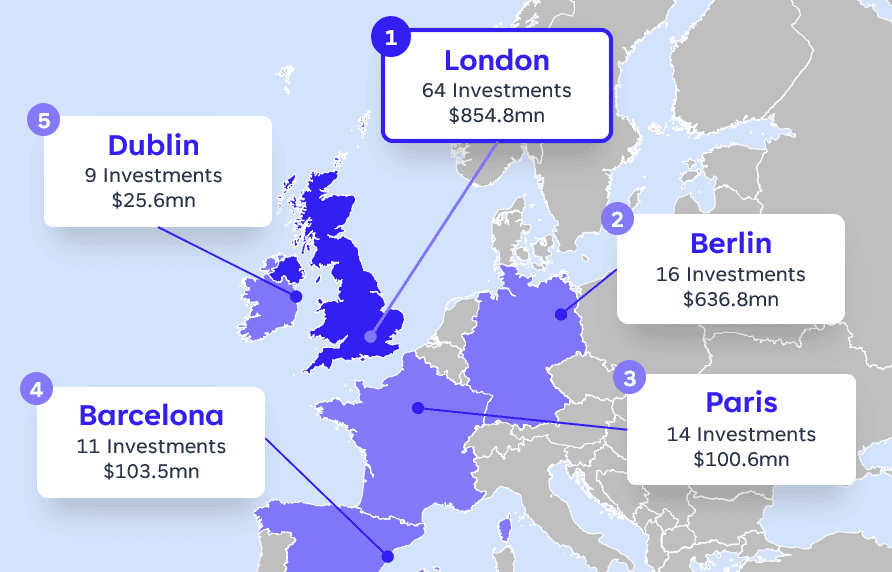

European VC Industry Hotspots

In July, London remains the hotspot of the European VC industry, with Berlin securing the second spot.

As in the previous months, the UK led the way with the most investment rounds at 106, followed by Germany with 46 and France with 43.

When ranked by investment volume rather than the number of investments, Rotterdam ($153.2mn), along with the German cities Planegg ($150.0mn) and Mannheim ($120.2mn), secure position 3-5.

PE Acquisitions Overview

Private Equity (PE) acquisitions increased in July by 29% to 53, this marks the highest number of acquisitions of the last twelve months. Of those 53 acquisitions, 10 included companies based in the UK, followed by Germany with 8.

With the increase in PE acquisitions, their share as part of the total 440 investment rounds in June (VC + PE) increases to 12%.

The largest known acquisition was Apollo’s acquisition of UK-based Evri, a multinational delivery company for $3.5 billion.

- % of all investment rounds

- Number of PE acquisitions

*All data from CrunchBase, as of August 14, 2024.

Partner with us

Unlock the full potential of your financial strategy with Trustventure’s expert guidance. Whether you’re navigating challenges in the financial sector, seeking advice on corporate financing, or enhancing your planning and controlling processes, we’re here to empower your journey and help you create transparency and confidence for you and your investors.

Ready to elevate your financial game? Reach out to us today using our contact form or drop us a direct message at office@trustventure.de. Work with us to achieve your financial success! 🚀